In today’s fast-changing fashion landscape, companies that rely solely on intuition risk falling behind. Leading brands and sourcing partners depend on marketing research to develop collections, target the right audiences, and forecast trends with precision.

Marketing research provides the data-driven insights needed to reduce risks, optimize investments, and deliver products that resonate with consumers.

Let’s break down the four key types of marketing research most commonly used by fashion companies:

1. Analysis of Economic Indicators

Economic conditions have a direct impact on how, when, and what consumers buy. Apparel & Fashion brands monitor macroeconomic trends to align pricing, inventory, and expansion plans.

What They Analyze:

- Consumer spending trends (e.g., rising or falling disposable income)

- Inflation and interest rates affecting purchasing power

- Currency fluctuations, especially for import/export-dependent businesses

- Unemployment rates and labor costs impacting manufacturing

How It’s Used:

- Adjust pricing strategies based on economic pressure

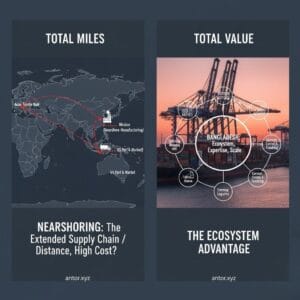

- Shift sourcing to cost-effective regions during downturns

- Time product launches around economic recovery periods

2. Market Analysis

This research focuses on understanding the overall apparel market: competition, growth potential, customer segments, and sales performance across channels.

What They Analyze:

- Market size and growth rates by region or product category

- Competitor analysis, including pricing, positioning, and collection structure

- Retail channel trends, such as eCommerce vs. brick-and-mortar performance

- Emerging markets and demographic shifts

How It’s Used:

- Identify white spaces and category opportunities

- Benchmark against competitors

- Expand or contract brand presence in specific markets

- Allocate marketing budgets more effectively

3. Consumer Research

Understanding the consumer is at the heart of fashion success. Brands use both qualitative and quantitative methods to capture preferences, behaviors, and pain points.

What They Analyze:

- Style preferences, color choices, and fit expectations

- Buying motivations and triggers (e.g., values, trends, social proof)

- Demographic data, including age, gender, location, income

- Lifestyle segmentation and psychographics (interests, aspirations)

Research Methods:

- Online surveys and focus groups

- In-store feedback and product testing

- Social media sentiment analysis

- CRM and purchase behavior tracking

How It’s Used:

- Design collections tailored to specific audiences

- Personalize marketing campaigns

- Improve sizing, fit, and product features

- Strengthen brand loyalty and engagement

4. Product Research

Before full-scale production, brands conduct research to test and refine their products. This can prevent costly errors and ensure high sell-through rates.

What They Analyze:

- Prototype testing for fit, comfort, and aesthetic appeal

- Pricing sensitivity and perceived value

- Colorway and silhouette testing for trend validation

- Fabric performance and user experience

How It’s Used:

- Select winning SKUs for production

- Eliminate underperforming styles early

- Improve garment specs and construction before launch

- Reduce returns and improve customer satisfaction

Why It Matters

In fashion, every collection is an investment—and every misstep costs time, money, and reputation. Marketing research provides the clarity needed to make confident decisions in a highly competitive environment.

Whether you’re a brand planning your next capsule, a sourcing company advising clients, or a manufacturer aligning with buyer needs—understanding these types of research can significantly improve your impact and profitability.

Final Thoughts

Fashion is no longer driven by guesswork—it’s guided by insights. From tracking economic indicators to understanding consumer lifestyles and testing prototypes, today’s most successful fashion companies integrate marketing research at every stage of product development.

At antor.xyz, I share tools, strategies, and sourcing knowledge to help brands make informed decisions and build stronger supply chains—backed by data.