Last updated: December 20, 2025

Bangladesh vs China vs Turkey denim woven sourcing decisions depend on MOQ, FOB cost structure, and production vs transit lead time. If you’re sourcing denim (jeans, jackets, workwear) or woven (shirts, chinos, outerwear) and deciding between Bangladesh vs China vs Turkey, this guide helps you choose the best-fit country for your buying programme – based on MOQ reality, FOB drivers, and lead time, not generic rankings.

Bangladesh’s ready-made garment exports reached US$38.48B in 2024, keeping it among the world’s top apparel exporters. The EU remained the largest market for Bangladesh garments, with reporting showing the EU at about 50% of Bangladesh’s RMG exports in 2024 (UK reported separately in some datasets). The US is also a major market; reporting shows Bangladesh exported around US$7.34B of apparel to the US in 2024 and held roughly 9.26% share of US apparel imports.

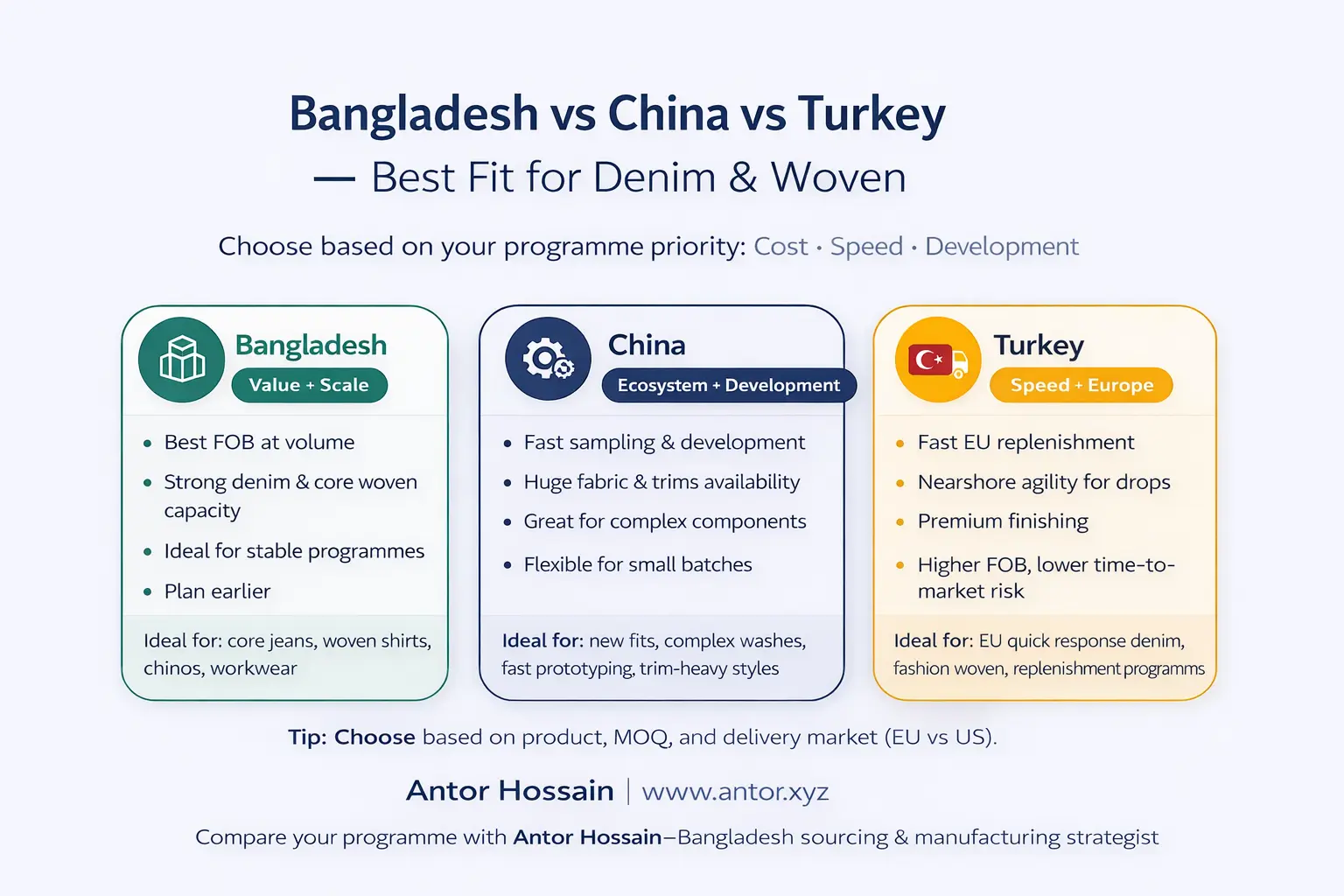

Quick answer: which country is best for what

- Choose Bangladesh if your goal is best FOB value at scale for core denim and woven programmes, and you can plan earlier.

- Choose Turkey if you sell to Europe and need nearshore speed and quick replenishment (often higher FOB, lower time-to-market risk).

- Choose China if you need fast development, strong materials/trim ecosystem, and flexibility for small-batch complexity.

Bangladesh vs China vs Turkey: buyer comparison table (denim + woven)

| Factor | Bangladesh | China | Turkey |

|---|---|---|---|

| Best for | Competitive FOB at scale, core denim + woven basics | Fast development, wide material ecosystem, complex components | EU nearshore speed, premium finishing, quick replenishment |

| MOQ reality | Best pricing usually needs higher consolidated volume | Often flexible depending on supplier model & material availability | Often workable for smaller repeat drops (EU-driven) |

| Lead time (programme) | Commonly longer; planning discipline needed | Often faster sampling + development cycles | Fastest to EU for repeat/replenishment |

| Transit advantage | Sea freight to EU/US = weeks | Sea freight to EU/US = weeks | EU road/short sea = days (depending lane/borders) |

| Denim washing/finishing | Very strong at volume (core + fashion washes) | Strong + broad chemical/trim ecosystem | Strong premium finishing + quick EU response |

| Best-fit business model | Scale/value programmes | Development speed + complexity | Speed-to-market + replenishment |

1) MOQ: what buyers should expect (and how to negotiate)

MOQ is rarely “one number”. It usually combines:

- Fabric MOQ (dye lots, print runs, mill minimums)

- Wash MOQ (denim laundries batch by wash recipe)

- Line efficiency (setup time, SMV, complexity)

- Trim MOQ (zippers, buttons, rivets, labels)

Typical MOQ ranges (practical buyer reality)

These are common ranges seen in sourcing programs. Your exact MOQ depends on fabric, wash, color count, and supplier model.

- Denim jeans: often workable from 300–800 pcs per wash/color for test capsules; best pricing usually from 1,000+ pcs per color/wash.

- Woven shirts/chinos: often workable from 500–1,000 pcs per color for simple solids; higher if special fabric/print.

- Outerwear: MOQs vary widely due to trims + fabric; many programs land around 300–800 pcs per style when materials are aligned.

How to lower MOQ without killing your costing

- Reduce colorways (2 colors beat 6 colors).

- Use stock-supported fabrics or supplier-recommended equivalents.

- Commit to a repeat plan (e.g., 3 drops over 6 months).

- Keep wash recipes limited (denim).

2) FOB: why “cheapest country” is the wrong question

FOB is driven more by fabric + finishing + efficiency than by “cheap labor”. For denim and woven, the biggest drivers are:

- Fabric cost (often the #1 cost component)

- Wash/finish cost (denim can swing heavily here)

- SMV + productivity (style complexity matters)

- Quality risk (rework, shade issues, wash variation)

- Compliance & EHS cost (audits, systems, remediation)

How buyers should compare countries: compare total landed cost + time-to-market risk. Turkey may look higher on FOB but can reduce lost sales and markdown risk by shipping faster into EU. Bangladesh usually wins on value when your programme is stable and scalable.

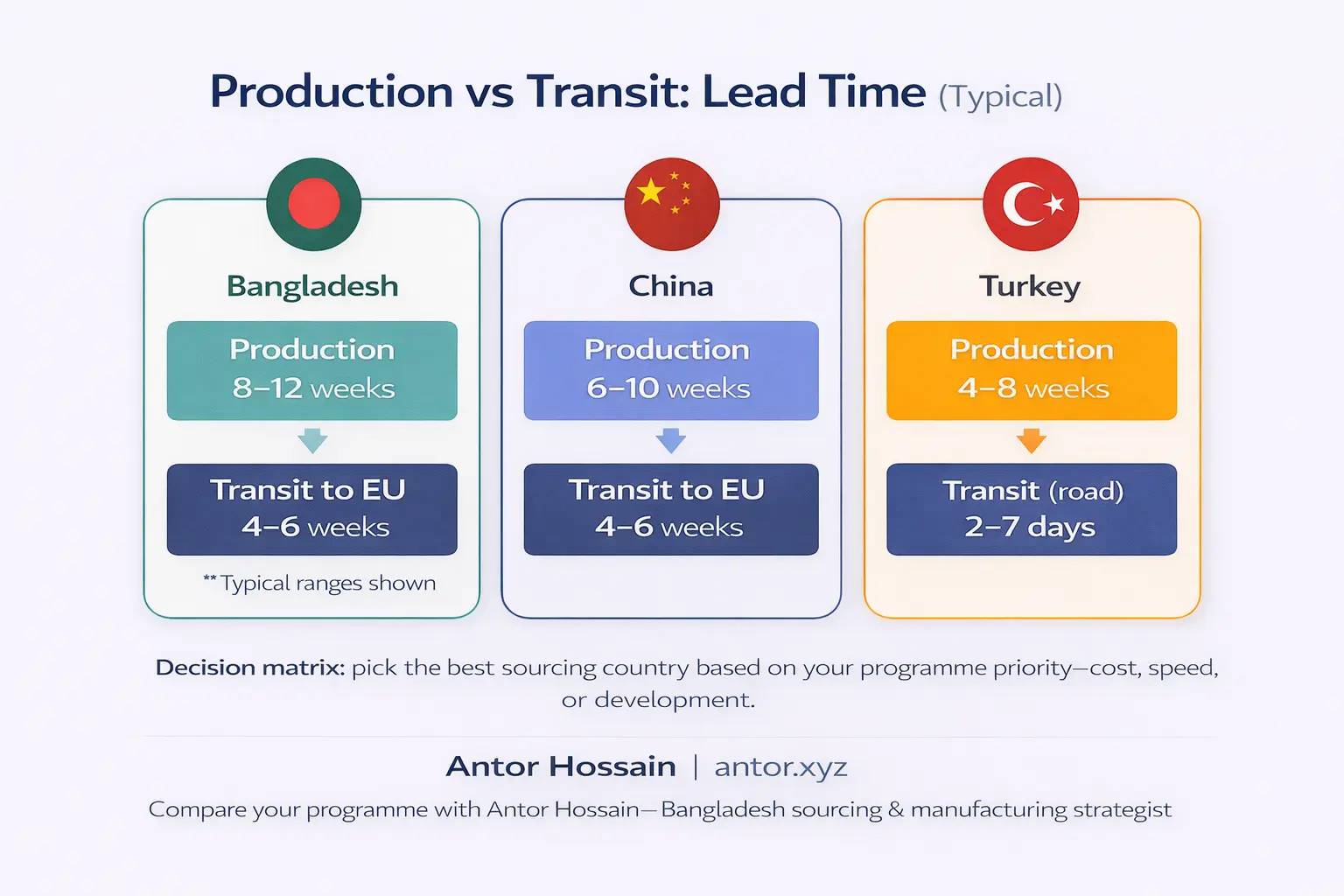

3) Lead time: production lead time vs transit time

Lead time has two parts:

- Production lead time: sample → approvals → bulk → finishing → packing

- Transit time: factory → port/airport → destination DC

Bangladesh lead time reality

Multiple studies and industry references commonly cite Bangladesh lead times around 90–120 days for many garment programmes, depending on fabric sourcing, approvals, and booking season. High-performing programmes can be shorter, but planning discipline is key.

Typical transit times (rough planning ranges)

- Sea freight (Asia → EU/US): often 20–45+ days depending on service, routing, congestion, and season.

- Road freight (Turkey → EU): often within a few days to about a week, depending on lane and border conditions.

- Air freight: fastest, but costlier—used for urgent launches or late approvals.

A simple buyer timeline that reduces delays

- Day 0–7: Confirm tech pack + target cost + compliance needs

- Week 1–3: Sampling + fit rounds

- Week 3–5: Fabric booking + lab dips + trims approvals

- Week 6–12+: Bulk production + finishing

- Final: Pre-final inspection + shipment booking

4) Trade & tariffs: EU vs US differences (important for 2026)

EU market

Bangladesh → EU: Under the EU’s Everything But Arms (EBA) arrangement for LDCs, eligible countries can receive duty-free, quota-free access to the EU for products (except arms/ammunition), subject to rules of origin and compliance conditions.

Bangladesh LDC graduation: The UN LDC portal lists Bangladesh’s scheduled graduation date as 24 November 2026. Buyers should monitor the EU’s transition arrangements and confirm rules at time of shipment.

Turkey → EU: The EU–Türkiye Customs Union supports “free movement” for eligible industrial goods in free circulation, typically proven by an A.TR. movement certificate. This is one reason Turkey performs strongly for fast EU programmes.

US market volatility

US tariff policy has been volatile. Reuters reported (Aug 2025) Bangladesh negotiated a reduced 20% US tariff on garment exports, down from a proposed 37%. For US programmes, always confirm the live tariff situation with your customs broker before final costing.

5) Compliance & safety: what buyers should verify (especially in Bangladesh)

Don’t accept “we have audits” as an answer. Ask for proof and status.

The International Accord/Bangladesh Agreement framework explains that inspections, remediation support, safety training, and worker complaints mechanisms are implemented in Bangladesh through the RMG Sustainability Council (RSC) for covered factories/programmes.

Compliance verification checklist (copy/paste to supplier email)

- Factory legal name + unit address + BGMEA/BKMEA membership

- RSC coverage status + latest CAP (corrective action plan) progress

- Fire/electrical/building safety documentation + remediation evidence

- Safety committee + training records

- Worker complaints mechanism info + non-retaliation policy

- Social compliance: amfori BSCI / SMETA / WRAP (as required)

- Chemical management (especially denim wash): wastewater + ETP evidence

- Traceability: fabric origin + transaction certificates for claims (GRS/RCS etc.)

- Subcontracting policy: written approval + disclosed capacity plan

6) Denim vs woven: what changes in the country decision

Denim (jeans, jackets, workwear)

- Bangladesh: strong for bulk denim programmes (core fits + scalable wash capacity).

- Turkey: strong for EU nearshore denim drops and fast replenishment.

- China: strong for development-heavy denim (fast sampling + complex components).

Woven (shirts, chinos, outerwear)

- Bangladesh: strong for classic woven programmes at volume and competitive FOB.

- Turkey: strong for EU speed and frequent refresh cycles.

- China: strong for rapid prototyping and wide material variety.

7) Decision scorecard (use this in your buying meeting)

| Programme priority | Bangladesh | China | Turkey |

|---|---|---|---|

| Lowest FOB at scale | 5 | 3 | 2 |

| Small-batch flexibility | 2 | 4 | 4 |

| Fast EU replenishment | 2 | 3 | 5 |

| Development + materials ecosystem | 3 | 5 | 3 |

| Denim finishing at volume | 5 | 4 | 4 |

Scoring is a buyer planning tool, not a “country ranking”. The best choice depends on your product, fabric, and calendar.

Compare my programme (CTA)

If you share your programme details, we’ll recommend the best-fit route (Bangladesh vs China vs Turkey) and match you with compliant options for denim and woven.

Send these 7 details:

- Product (denim jeans / woven shirt / outerwear etc.)

- Fabric (composition + GSM/oz)

- Wash/finish (for denim)

- Target MOQ per color

- Target FOB range (if you have it)

- Delivery market (EU/UK/US) + target ship date

- Compliance requirements (BSCI/SMETA/WRAP + certifications)

FAQ

Is Bangladesh always cheaper than Turkey and China?

Not always. Bangladesh often wins on FOB at scale, but Turkey can win on time-to-market in the EU, and China can win when development speed + ecosystem reduce total development friction and risk.

Which is fastest to Europe?

Turkey is typically fastest to Europe because road and short-sea options can be much quicker than Asia-to-EU ocean freight.

What’s the biggest 2026 risk factor?

Trade volatility (especially US tariffs) and calendar risk (late approvals + congestion). Always confirm tariff status and lock approvals early.

How do I verify safety compliance in Bangladesh?

Ask for RSC/Accord coverage status (if applicable), remediation progress evidence, safety committee/training records, and proof of a worker complaints mechanism policy and practice.

Sources

- European Commission: Everything But Arms (EBA) scheme

- UN LDC Portal: Bangladesh graduation status

- European Commission (Taxation & Customs): EU–Türkiye Customs Union and A.TR. certificate

- International Accord / Bangladesh Agreement documents and programme updates (RSC implementation)

- Reuters reporting on US tariff negotiations (2025)

2 Responses