Buyer-first compliance checklist

Quick summary (for busy buyers)

- What EU & US buyers typically mean by “compliance” (in practical sourcing terms)

- What to ask for before you send an RFQ (documents, process, and verification steps)

- How to reduce supplier risk without slowing down your development timeline

Who this is for

Brands, importers, and sourcing teams evaluating Bangladesh factories for woven & denim programs—especially when your internal team needs a clear, document-based pre-check before sampling or booking capacity.

Last updated: 8 January 2026

Need compliant factory options?

Share your product, target price, and quantity—I’ll guide you to realistic, compliance-aligned options.

Note: This guide is practical sourcing guidance, not legal advice. Buyer requirements vary by brand, market, and product category.

On this page

Table of contents

- Compliance in plain English (for buyers)

- EU & US buyer requirements in 2026 (what changes your checks)

- Certifications & audits buyers recognize (what they mean)

- Factory pre-check checklist (documents + verification)

- Red flags (common pitfalls buyers miss)

- How Antor pre-screens factories (process + expectations)

- FAQs

- Next step: Send your RFQ (denim / woven / outerwear)

Compliance in plain English (for buyers)

In sourcing, compliance means a factory can prove—on paper and in practice—that it meets buyer-required standards for workplace safety, labor practices, and (increasingly) traceability and environmental controls. Think of it as your “risk baseline” before sampling, booking capacity, or placing a PO.

The 4 parts buyers usually mean

1) Safety & building readiness

Fire safety, electrical safety, evacuation routes, and evidence that the site is being monitored and maintained.

2) Labor & HR controls

Working hours, wages, contracts, grievance channels, age verification, and policies buyers can audit.

3) Traceability & documentation

Clear supplier identity, subcontracting controls, and consistent records that match what the factory claims.

4) Environmental & chemical controls

Waste handling, effluent (where relevant), and chemical management aligned with buyer RSL/MRSL expectations.

In practice: what you should ask for (before sending an RFQ)

- Factory profile: legal name, address, ownership, and production scope (no subcontracting surprises).

- Recent audit summary (if available): scope + date + key findings + corrective action status.

- Buyer compliance pack: HR policies, wage/working-hours controls, grievance mechanism, age verification process.

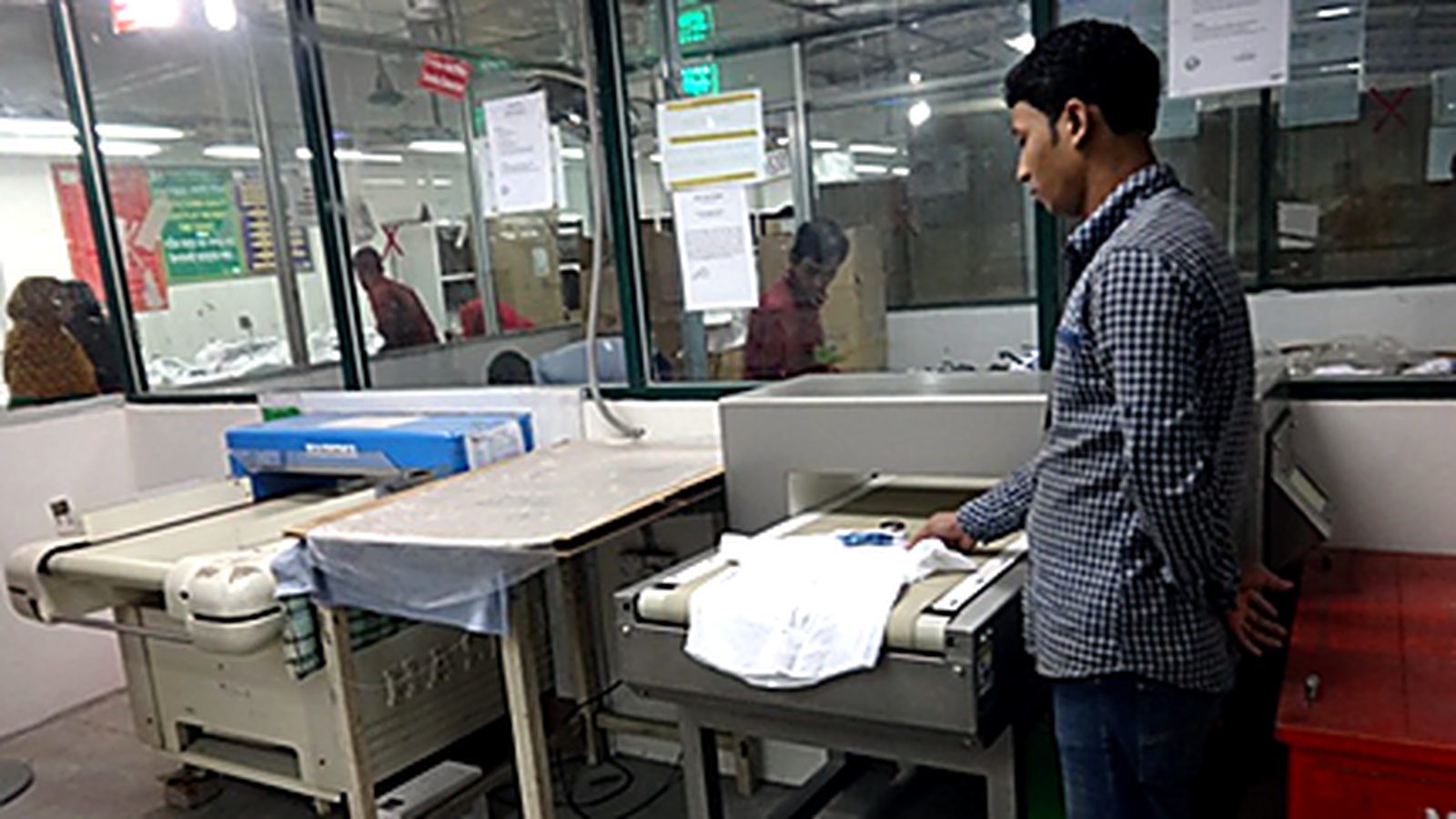

- Site photos/videos that match the claims: production lines, safety signage, evacuation routes, compliance boards.

- Capability proof: similar product references (woven/denim), machinery list, QC checkpoints, inline/final inspection flow.

Next, we’ll map these checks to what EU & US buyers typically require in 2026—and how to avoid slow, expensive re-check cycles.

EU & US buyer requirements in 2026 (what changes your checks)

In 2026, most serious buyers treat “compliance” as ongoing due diligence, not a one-time audit file. That means they’ll look for clear documents, traceability signals, and proof you control subcontracting—especially for woven and denim programs.

What changes your checks (practically)

- From “audit only” → “audit + evidence”: buyers expect documents that confirm the audit picture matches reality (policies, records, photos, CAP closure).

- From “factory only” → “supply chain clarity”: buyers ask where fabric, trims, and key processes come from (to reduce hidden risk).

- From “no subcontracting” → “controlled subcontracting”: if any process is outsourced, buyers want approvals + records + visibility.

- From “one-time check” → “ongoing updates”: the best factories keep a ready compliance pack that can be refreshed quickly.

EU buyers often emphasize

- Documented due diligence: policies + records + evidence of corrective actions.

- Subcontracting control: clear approvals and visibility on outsourced steps.

- Chemical & environmental controls (where relevant): RSL/MRSL alignment; permits/process controls for wet processes.

- Consistency: the factory story, documents, and floor reality must match.

US buyers often emphasize

- Traceability signals: supplier identity, process visibility, and records that support claims.

- Forced-labor risk controls: clear policies + supplier mapping (buyers want “no surprises”).

- Country-of-origin clarity: documents match the real production flow.

- Subcontracting control: who does what, and how it’s governed.

Fast win: build a “Buyer Compliance Pack” once

- Factory profile + production scope (and what is not done in-house)

- Audit summary (if available) + corrective action status

- HR policies + working-hours/wage control explanation

- Subcontracting policy + approval workflow

- Traceability basics: key suppliers for fabric/trims + process map (high level)

- QC flow: inline/final checkpoints + AQL approach (if you use one)

Certifications & audits buyers recognize (what they mean)

Buyers often ask for “certificates” as shorthand for risk control—but not all standards mean the same thing. The safest approach is to treat every claim as verifiable documentation (scope, site name, dates, and issuing body), not as a marketing badge.

Common standards buyers recognize (and what they mean)

| Category | Examples you may see | What buyers use it for (practical meaning) |

|---|---|---|

| Social compliance audits | amfori BSCI (audit), SMETA (shared via Sedex), WRAP (facility certification) | Baseline labor/HR controls and documented follow-up on corrective actions (always verify site + scope + dates) |

| Product safety / chemical (restricted substances) | OEKO-TEX® STANDARD 100 | Confidence that textiles/components are tested for harmful substances (certificate scope + product class matter) |

| Organic chain-of-custody | GOTS, Organic Content Standard (OCS 100 / OCS Blended) | Proof organic fiber claims are tracked through the supply chain; GOTS also adds processing requirements (verify scope + certified sites) |

| Recycled chain-of-custody | Global Recycled Standard (GRS), Recycled Claim Standard (RCS) | Verification that recycled inputs are tracked through the supply chain; GRS includes additional processing criteria (RCS is chain-of-custody focused) |

| Quality management systems | ISO 9001 | Signals process control and quality management discipline; not a guarantee of product quality by itself |

| Security / trade compliance | C-TPAT | Supply-chain security expectations for some US importer programs (relevant mainly when the buyer/importer requires it) |

| Environmental / building certification | LEED (Gold / Platinum) | Building sustainability/efficiency credential (useful for ESG reporting; not a labor or product compliance audit) |

| Assessment frameworks (not “certificates”) | Higg FEM, Higg FSLM, SLCP (CAF) | Standardized assessment data buyers may request to compare facilities; confirm who verified it, when, and how results are shared/accepted |

| Fiber / material programs | BCI / Better Cotton (incl. “BCI Cotton” terminology), Masters of FLAX FIBRE™ | Program participation/traceability rules for specific fibers; confirm claim type, chain-of-custody model, and supporting documentation |

| Bangladesh building safety program context | RMG Sustainability Council (RSC) safety program (you may still see legacy “Accord” references on older documents) | Independent workplace safety inspections/remediation tracking in Bangladesh context; verify current status and the specific factory/site covered |

Buyer tip: how to verify fast (without slowing your calendar)

- Ask for the latest certificate/audit report PDF (not a screenshot) and check the validity dates.

- Confirm the site name + address on the document matches the production location you’re using.

- Check the scope: what processes/materials are covered (and what is not).

- Ask for the certificate number and issuing body so your team can verify it in the official database (when available).

- For audits, request key findings + CAP status (what was fixed, when, and evidence).

If you have specific requirements (e.g., GOTS/GRS/OEKO-TEX), share them in your RFQ. I’ll only shortlist factories that can provide valid, current proof matching your scope.

Factory pre-check checklist (documents + verification)

This checklist is designed for fast, buyer-safe screening. It helps you confirm a factory’s identity, scope, control of subcontracting, and proof of compliance—before you spend time on sampling or booking production capacity.

Use a 2-step screen (fast + safe)

Step 1: Desk review (documents)

Collect a basic compliance pack + capability proof. If the identity, scope, or dates don’t match, stop early.

Step 2: Verification (reality check)

Confirm consistency via live call/video, recent floor photos, and (if needed) reference work and sample evaluation.

A) Identity & production scope (non-negotiable)

- Legal factory name + address (must match documents and the production site you’ll use)

- Ownership/management contact + official email domain (avoid mismatched identities)

- Production scope statement: what is done in-house vs what is outsourced

- Subcontracting policy: whether allowed, and how approvals and visibility are controlled

- Machinery + lines overview (for your product category: woven/denim)

B) Social compliance & workplace controls (evidence-based)

- Most recent audit summary (if available): scope + date + key findings + corrective action status

- HR policy pack: working hours, wages, contracts, grievance mechanism, age verification process

- Training & safety evidence: drills, safety committee records, signage photos, and basic safety controls

- Worker documentation consistency: processes that prevent “paper-only compliance”

C) Technical capability & quality system (can they execute your spec?)

- Similar product proof: recent woven/denim styles comparable in construction and finish

- QC flow: inline + endline + final inspection checkpoints (who signs off, what records exist)

- Measurement + shade control approach (especially important for denim and piece-dyed woven)

- Testing plan: which tests are done in-house vs third-party (based on buyer requirements)

- Sample readiness: pattern, sampling timeline, and clear communication process

D) Traceability & supply chain clarity (reduce hidden risk)

- Key suppliers list (high level): fabric/trims sources and any critical processes

- Process map: where each step happens (cut/sew, embroidery, printing, washing, finishing, packing)

- Subcontractor approvals (if any): names, locations, and how the factory manages visibility

- Consistency check: documents, addresses, and process story all match

Denim note (scope-based)

- If your program is cut & sew only, ask for a simple process map showing no wet processing in the factory scope.

- If your program includes washing/finishing, confirm where it happens (in-house or approved partner) and ask for chemical management and basic process controls relevant to that scope.

Next, we’ll translate this into a simple “verify or pause” decision rule—then cover the red flags buyers should never ignore.

Red flags (common pitfalls buyers miss)

These red flags don’t always mean “bad factory”—but they do mean you should pause, verify, and avoid moving to sampling/booking until the story and documents match.

Identity & documents (most common)

- Name/address mismatch between documents, email signature, and the actual production site.

- Expired certificates or missing validity dates; only screenshots shared.

- “We have everything” but no willingness to share a basic compliance pack.

- Audit scope confusion: report/certificate doesn’t clearly cover the site or process you’re using.

- Subcontracting is unclear (“No subcontracting” stated, but process map suggests otherwise).

- Too many intermediaries in communication with no clear factory owner/management contact.

Capability & execution risk

- Unrealistic promises on MOQ, price, or lead time without any proof of similar work.

- No clear QC flow (who checks, when, and what records exist).

- Sample confusion: unclear timeline, missing tech questions, or no pattern/sampling process.

- Process story changes from call to call (washing/printing/embroidery location keeps moving).

- Pressure tactics (rush to deposit/booking before documentation is shared).

- Poor traceability: cannot name key fabric/trims sources at a high level.

Simple rule: Verify or pause

- If the site name/address doesn’t match across documents → pause.

- If the scope (what’s in-house vs outsourced) is unclear → pause.

- If the factory won’t share basic proof (validity dates, scope, CAP status) → pause.

- If price/lead time sounds “too good” with no comparable references → verify before sampling.

What to do instead (buyer-safe next step)

Ask for a short compliance pack (latest documents + scope + site details) and a quick process map. If it checks out, then move to sampling. If it doesn’t, you’ve saved weeks of risk and rework.

How Antor pre-screens factories (process + expectations)

My goal is simple: help you move fast without taking unnecessary compliance risk. I pre-screen factories with an evidence-first approach (documents + scope + consistency), then align capability to your product (woven/denim), MOQ, target price, and lead time.

My pre-screening process

1) Intake (buyer requirements)

Product type, fabric, construction, MOQ, target price, lead time, compliance standards required, and destination market.

2) Desk screen (proof pack)

I request a basic compliance pack and confirm site identity, validity dates, and scope match the production plan.

3) Capability match (woven/denim)

I match factories to your spec using similar-work references, machinery/lines, QC flow, and sample readiness.

4) Reality check (consistency)

Quick call/video + recent floor visuals to confirm the story matches documents (and subcontracting is controlled).

5) Shortlist + next steps

You get realistic options and a clear next step: sampling plan, timeline, and what proof is needed for your internal approval.

What I need from you

- Product type + construction details (woven/denim)

- Target quantity (per color/style) + MOQ constraints

- Target FOB range (or cost drivers you must hit)

- Required standards (e.g., BSCI/SMETA/OEKO-TEX/GOTS/GRS etc.)

- Destination market + timeline

What you get

- Shortlist of realistic factory options (fit to your spec + capacity)

- Clarity on what’s in-scope vs outsourced (process map)

- Compliance proof direction (what to request/verify)

- Next-step plan: sampling → approvals → production

Important note (honest + buyer-safe)

Compliance requirements vary by brand, product, and market. I don’t “guarantee” approvals—what I do is reduce risk by matching your requirements to factories that can provide valid, current proof and consistent production scope.

FAQs

Quick answers for buyers

These FAQs are written for sourcing teams evaluating Bangladesh factories for woven & denim. If your brand has a specific compliance manual, we align to that scope.

1) What should I request first to screen a factory for compliance?

Start with a basic compliance pack: site legal name/address, production scope (in-house vs outsourced), latest audit/certificate summaries (if available), HR policies (working hours, wages, age verification), and a short process map. If the site identity and scope don’t match, pause early.

2) What’s the difference between BSCI, SMETA, and WRAP?

They’re social compliance audit frameworks used by different buyer ecosystems. Buyers use them as a baseline signal—not a full guarantee. What matters most is: site coverage, validity dates, scope, and whether corrective actions were closed with evidence.

3) Does OEKO-TEX Standard 100 mean the factory is “sustainable”?

Not exactly. OEKO-TEX Standard 100 is mainly used as a product safety / harmful substances confidence signal for materials/components within a defined scope. It doesn’t replace labor audits, building safety documentation, or environmental permits—so treat it as one piece of the puzzle.

4) How do I reduce subcontracting risk?

Ask for a simple process map showing where each step happens (cut/sew, printing, embroidery, washing, finishing). If any step is outsourced, request the subcontractor name/location and the approval/visibility process. If the story changes over time, pause and verify.

5) What if a factory has no recent audit report?

You can still screen them—but you need stronger evidence: site identity docs, HR policies/records, facility visuals, controlled subcontracting policy, and clear capability proof. Many buyers will require a third-party audit later, so plan that into your timeline if the brand mandates it.

6) How long should compliance screening take before sampling?

For a first-pass screen, aim for 2–5 working days if the factory can share documents quickly. If documents are incomplete or scope is complex (multiple sites, outsourced processes), screening takes longer—so it’s better to verify early than fix issues after sampling starts.

7) For denim, what changes if washing/finishing is involved?

If your denim includes washing/finishing, you must confirm where it happens (in-house vs approved partner) and ensure the scope is documented. Ask for a clear process map and basic chemical management controls relevant to that scope. If it’s cut & sew only, the process map should show no wet processing in the factory scope.

8) What minimum details should I include in an RFQ to get accurate pricing?

At minimum: product type (woven/denim), fabric spec (composition, GSM/oz, weave), construction details, target quantity per color/style, target delivery window, and destination market. Add compliance requirements (e.g., BSCI/SMETA/OEKO-TEX/GOTS/GRS) so the shortlist matches your internal approval scope.

9) How can my team verify certificates quickly?

Ask for the PDF (not a screenshot), confirm validity dates, match the site name/address, and check the scope covers your processes/materials. When an official database exists, use the certificate number and issuing body to validate.

10) Can you support “concept to delivery” programs?

Yes—when you share your scope clearly. The key is alignment: product category (woven/denim), target MOQ, lead time, and required standards. From there, the process is: requirement intake → proof-based screening → capability match → sampling plan → production readiness.

Next step: Send your RFQ (denim / woven / outerwear)

Ready when you are

Send your RFQ — I’ll guide you to compliant, realistic options

Share your product details, quantity, target FOB range, lead time, and required standards. I’ll reply with a practical next-step plan and options that fit your scope.

- Product: woven/denim + construction details

- Fabric: composition + GSM/oz + finishes

- Quantity: per style/color (MOQ constraints)

- Target FOB: range (or cost drivers)

- Timeline: sample + shipment window

- Required standards: (e.g., BSCI/SMETA/OEKO-TEX/GOTS/GRS etc.)

- Destination market: EU/US/UK/other

Trust note: I’ll only recommend options that can provide valid, current proof aligned to your scope. No inflated claims, no guessing.